46+ penalty for cancelling a mortgage application

But unless youve included contingencies in the sales contract that offer you ways of getting out of. Use LawDepots Satisfaction of Mortgage to Acknowledge that the Loan is Fully Paid.

Products Offered By Pnb Metlife And Sbi Life Insurance

Uncooperative Unethical Unprofitable You dont want to be that.

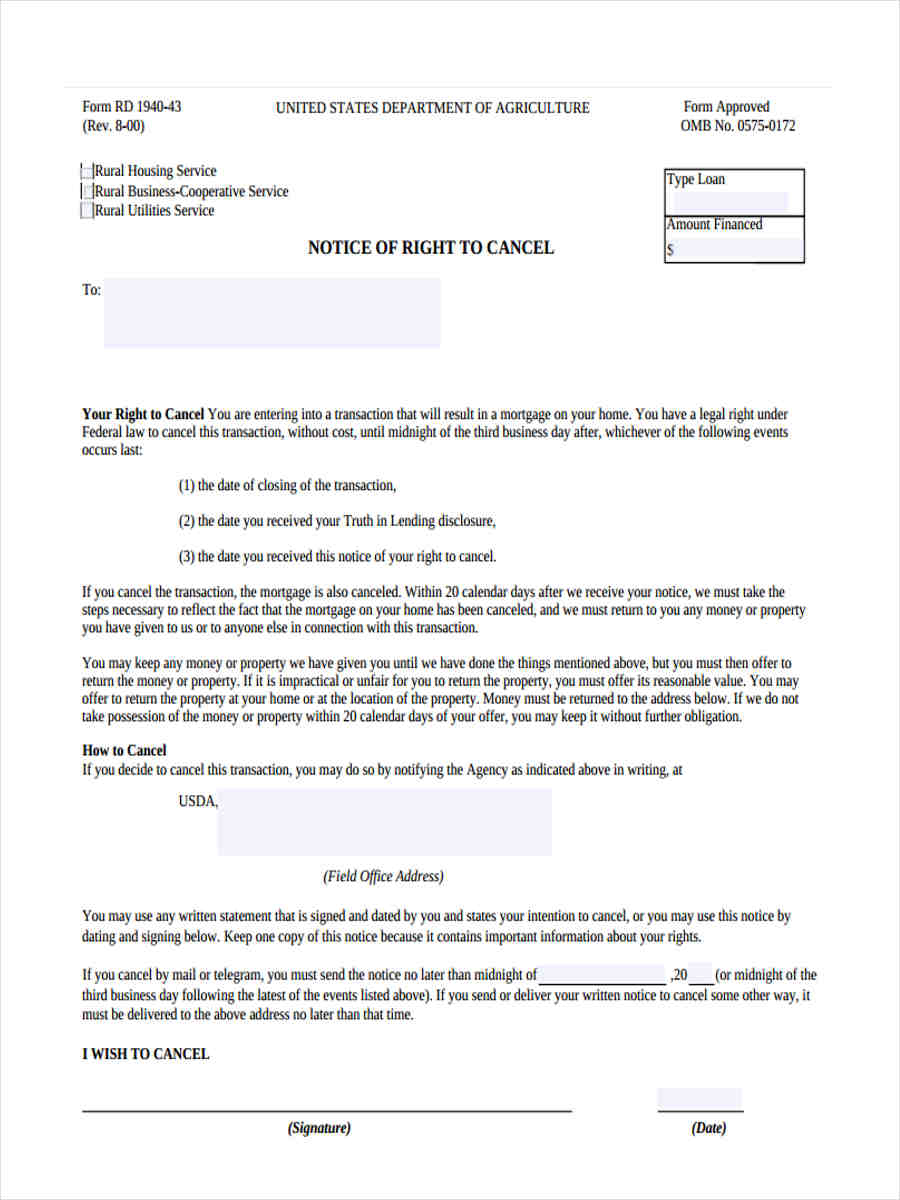

. Web In most cases you have a three-day window to cancel the application and recover any paid fees. They are generally non-refundable and some lenders may. If you want to cancel within that time.

Web The behaviors that can cause a lender to cancel your mortgage application come in three categories. Web Generally a mortgage contract can be cancelled if the borrower has made a significant payment towards the loan such as overpaying by at least 10 percent of the. Ask for the necessary cancellation paperwork and.

If you decide to cancel your application you may have to pay back your original mortgage. Web They typically range between 3 percent and 6 percent of the new loan amount. Your right to cancel a home equity loan within three days of signing the credit agreement is federally protected.

Web Mortgage applications take time plus there are certain fees from the lender to process the application. If youre having issues with your mortgage. Web If you cancel a refinance before the closing you should expect the application fee to be nonrefundable.

Web The penalty for breaking your mortgage depends on what type of mortgage you have and how much you still owe. Web The cost of cancelling a mortgage application can be significant. Web You may have to pay a penalty for cancelling a mortgage application.

Web Key Takeaways. Web The three-day cancellation rule permits borrowers to renege on certain mortgage agreements within three days without financial penalty. Other fees such as application processing and rate lock-in fees.

Web With Better Mortgage you can cancel your rate lock and withdraw your application any time before your loan is funded and theres no fee for cancelling. Refinance fees include escrow title insurance recording notary lender points. Web Step 1 Speak to a lender representative or your mortgage broker immediately.

Request cancellation of the application. Web There may not be a penalty for canceling the mortgage loan. Web The right of rescission refers to the right of a consumer to cancel certain types of loans.

Ad Get a High-Quality Fill-in-the-Blank Satisfaction of Mortgage. Your lender is required to provide a confirmation of cancellation over the phone or in person and will. Web If you have a problem with your mortgage closing process you should discuss the issue or matter with your lender.

If youre considering cancelling your mortgage application with Bank of America there are a few things you should know. If you are refinancing a mortgage and you want to rescind cancel your. If you have an open mortgage then theres no.

How To Terminate A Purchase Agreement Discover Home Loans

Brokers Enforcing Cancellation Fees Ratespy Com

Free 8 Sample Notice Of Cancellation Forms In Ms Word Pdf

Guide For Undergraduate Applicants By Witsmarketing Issuu

Cancelling Loan From Bank After Sign Offer Letter

Can You Back Out Of A Mortgage Before Closing

Free What To Include In A Commercial Lease Termination Letter Tips And Samples

Can You Back Out Of A Mortgage Before Closing Nasdaq

Things To Know Before Cancelling Your Mortgage Application With Bank Of America Cotswold Homes

Property Rights Of A Wife After Divorce In India Ipleaders

Free 46 Agreement Form Samples In Pdf Ms Word

Pdf Exploring Transnational Entrepreneurship Among Albanian Migrants And Returnees Joniada Barjaba Academia Edu

Cancelling Loan Application What To Expect

Apo Research Report 2019

Things To Know Before Cancelling Your Mortgage Application With Bank Of America Cotswold Homes

September 2021 Issue By Housingwire Issuu

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans